Top Tips for Handling Canceled Payments on Cash App

If you use the Cash App, you may send and receive money easily with the app’s built-in payment processor. Payment cancellations can occur, however, and they might leave you wondering what to do next. Continue reading to discover effective methods for overcoming these annoying interruptions. This post lays down controllable, actionable measures in 100 thoughtful words. Use them to get your money back or to repair a canceled payment.

If you have the correct information, you may fix payment problems, make future transfers better, and keep using Cash App’s platform. If you want to know how to fix your most significant issues with failed payments, stay on for three excellent ideas. In both short-term and long-term contexts, the following suggestions may help you find your way back to harmony.

Here’s an overview of tips for handling canceled payments on the Cash App:

- Understanding the common reasons for canceled payments

- Taking immediate action upon discovering a canceled payment

- Utilizing the Cash App, customer support is available for assistance

- Implementing preventive measures to avoid future canceled payments

- Exploring alternative payment options

- Understanding the dispute resolution process on Cash App

- Taking Legal Action as a Last Resort

- Ensuring the security of your Cash App account

- Educating others about potential pitfalls and effective solutions

- Conclusion and final thoughts

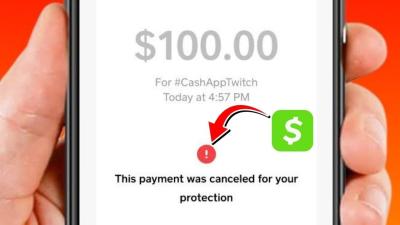

Understanding the common reasons for canceled payments

- Insufficient Funds: One of the most common reasons for canceled payments on the Cash App is insufficient funds in the sender’s account. Before initiating a payment, make sure you have enough balance to cover the transaction.

- Frozen Account: If your account is flagged for suspicious activity or if Cash App detects any unauthorized transactions, they may freeze your account, leading to canceled payments. Contact Cash App support to resolve this issue promptly.

- Incorrect Recipient Information: Providing incorrect recipient details, such as the wrong cash tag or bitcoin address, can result in canceled payments. Double-check the recipient’s information before sending money.

- Network Issues: Sometimes canceled payments may occur due to network issues or server problems on Cash App’s end. In such cases, wait for a while and try sending the payment again later.

- Security Concerns: Cash App prioritizes security, and if they suspect any fraudulent activity or breach of terms, they may cancel payments to protect users. Ensure your transactions abide by their terms and conditions.

- Bank Account Verification: If your bank account linked to the Cash App is not verified or has issues, it can lead to canceled payments. Verify your bank account to prevent such payment disruptions.

- Card Decline: If the linked debit or credit card associated with your Cash App account declines the transaction, payments may get canceled. Ensure your card details are up-to-date and the card is active.

- Payment Disputes: In the event that the recipient disputes a payment or raises a claim, Cash App may intervene and cancel the transaction until the matter is resolved. Communicate with the recipient to address any payment disputes promptly.

Taking immediate action upon discovering a canceled payment

When I notice a payment on the Cash App has been canceled, I spring into action to address the issue promptly. Here’s what I do:

- Check for Confirmation: First and foremost, I make sure that the sender of the payment actually initiated the cancellation. I look for any notifications or messages confirming the cancellation.

- Contact Support: Without delay, I reached out to the Cash App support team to report the canceled payment. I provide all the necessary details, such as the transaction ID, amount, and time of the payment.

- Review Account Activity: I thoroughly examine my account activity on the Cash App to understand if there are any other discrepancies or irregularities. This helps me identify any potential issues that may require attention.

- Update Payment Details: In case the canceled payment was due to incorrect payment information, I update my details to ensure future transactions are processed correctly.

- Follow Up: After reporting the canceled payment to support, I make it a point to follow up with them periodically to inquire about the status of the investigation and resolution process.

- Secure Account: As a precautionary measure, I review my account security settings and update my password if needed. This helps safeguard my account from any unauthorized access or further issues.

Taking immediate action upon discovering a canceled payment is crucial to resolving the issue efficiently. By following these steps promptly, I can work towards a speedy resolution and ensure that my transactions on the Cash App remain secure and reliable.

Utilizing the Cash App, customer support is available for assistance

I can contact Cash App customer support if I encounter any issues with canceled payments. Here are some steps to follow when seeking assistance:

- Contacting customer support: When a payment is canceled, I can reach out to Cash App customer support for guidance. This can be done through the app or via email.

- Providing the necessary details: I should be prepared to provide specific details about the canceled payment when contacting customer support. This includes the date and time of the transaction, the recipient’s information, and the amount involved.

- Seeking clarification: If I receive a notification about a canceled payment and have questions about why it was canceled, I can ask for clarification from customer support. They can provide insights into the reasons behind the cancellation.

- Requesting resolution: In cases where a canceled payment has caused inconvenience, I can request assistance from customer support to resolve the issue promptly. They may offer solutions or escalate the matter if needed.

- Being patient and persistent: Resolving canceled payment issues may take time, so it’s essential to be patient when dealing with customer support. If the matter is not resolved immediately, I can follow up with additional information or requests for updates.

Contacting Cash App customer support is a reliable way to address canceled payment issues and seek assistance in navigating through any complications that may arise.

Implementing preventive measures to avoid future canceled payments

I need to take proactive steps to prevent canceled payments on the Cash App from happening in the future. Here are some effective measures I can implement:

- Verify recipients: Before sending money, I must double-check the recipient’s details to ensure that I am sending money to the right person. This can help prevent accidental payments to the wrong individual.

- Maintain a strong internet connection: A stable internet connection is crucial when making transactions on the Cash App. I should ensure that I have a reliable internet connection to avoid any disruptions during the payment process.

- Enable notifications: By enabling notifications on the Cash App, I can receive instant alerts about any payment or transaction activity. This way, I can quickly address any issues that may arise, such as canceled payments.

- Keep the app updated. Regularly updating the Cash App to the latest version can help ensure that I have access to the most up-to-date security features and bug fixes, reducing the risk of payment cancellations.

- Monitor account activity: By regularly reviewing my transaction history and account activity, I can quickly identify any unauthorized or suspicious transactions. This proactive approach can help prevent canceled payments due to fraudulent activity.

- Contact customer support: If I encounter any issues with payments on the Cash App, I should not hesitate to reach out to customer support for assistance. They can provide guidance on resolving payment-related issues and offer valuable insights to avoid future canceled payments.

By incorporating these preventive measures into my Cash App usage habits, I can minimize the risk of canceled payments and ensure a smoother transaction experience in the future.

Exploring alternative payment options

I always make sure to have backup payment methods ready to go in case a payment on the Cash App gets canceled. Here are some alternative payment options I explored:

- Credit or Debit Card: I ensure my credit or debit cards are linked to my Cash App account. This way, if one payment method doesn’t go through, I can quickly switch to another without any hassle.

- Bank Account: Linking my bank account to the Cash App provides me with another reliable payment option. It’s convenient and helps me avoid any payment disruptions.

- Cash App Balance: Keeping funds in my Cash App balance is a smart way to ensure I always have a backup source for payments. I try to maintain a balance to cover unexpected situations.

- Gift Cards: When all else fails, using gift cards as a payment option can be handy. I make sure to have a few gift cards on hand that I can use in case of canceled payments.

Exploring these alternative payment options gives me peace of mind, knowing that I have backup plans in place. Being prepared for any payment scenario on the Cash App is essential to avoid any inconveniences or delays.

Understanding the dispute resolution process on Cash App

I have found that when a payment gets canceled on the Cash App, it can be frustrating. However, understanding the dispute resolution process can help navigate through these situations effectively. Here are some key points to keep in mind:

- Contact Customer Support: The first step I always take is to reach out to Cash App’s customer support. They can provide guidance on what steps to take next and assist in resolving the issue promptly.

- Provide Necessary Information: When escalating a canceled payment, make sure to have all relevant details ready. This includes transaction IDs, dates, and any communication related to the payment.

- Initiate a Dispute: If customer support is unable to resolve the matter, I initiate a formal dispute through the app. This involves providing a detailed description of the issue and supporting documentation.

- Allow Time for Resolution: Resolving payment disputes can take time, so I make sure to be patient throughout the process. The Cash App typically investigates the matter and provides updates on the status of the dispute.

- Follow Up: It’s essential to follow up regularly with Cash App regarding the dispute. This shows that I am actively engaged in resolving the issue and can help expedite the resolution process.

- Consider Other Options: If the dispute remains unresolved, I will explore other options, such as contacting my bank or card issuer for further assistance.

Through understanding the dispute resolution process on the Cash App and following these steps, I have successfully managed canceled payments and achieved satisfactory outcomes.

Taking Legal Action as a Last Resort

Sometimes, despite my best efforts, the issue with a canceled payment on the Cash App remains unresolved. In such cases, taking legal action might be the only option left. Here are some steps to consider when contemplating this route:

- Consult with a Legal Professional: Before proceeding with any legal action, I always advise seeking guidance from a legal professional. They can help assess the situation, determine the feasibility of a legal case, and provide insight into the potential outcomes.

- Gather Documentation: It is crucial to gather all relevant documentation related to the canceled payment. This includes transaction records, communication with Cash App support, and any other evidence that supports my claim.

- Review Cash App’s Terms of Service: Understanding Cash App’s terms of service is essential when considering legal action. It can provide insights into the company’s policies and procedures, which may impact the case.

- Consider Small Claims Court: If the amount in question falls within the small claims court limit, this can be a cost-effective way to pursue legal action. A small claims court typically offers a streamlined process for resolving disputes.

- File a Complaint: If all other avenues have been exhausted, filing a formal complaint with the relevant consumer protection agency or regulatory body may be necessary. This can potentially escalate the issue and prompt a resolution from the Cash App.

Remember, taking legal action should always be a last resort. It is essential to weigh the potential costs and benefits before pursuing this option.

Ensuring the security of your Cash App account

I. Use Strong Authentication:

- I always make sure to enable two-factor authentication on my Cash App account for an extra layer of security.

II. Keep personal information private:

- I am cautious about sharing any personal information or login credentials with anyone to prevent unauthorized access to my account.

III. Monitor Account Activity:

- Regularly checking my transaction history allows me to identify any unauthorized transactions quickly and report them to the Cash App.

IV. Update the Cash app regularly:

- I ensure that my Cash App is always up-to-date to benefit from the latest security patches and enhancements.

V. Beware of Phishing Attempts:

- I am cautious of suspicious emails or messages asking for my account details, as Cash App will never request sensitive information through these channels.

VI. Set Account Alerts:

- I have set up account alerts to notify me of any significant account changes or transactions, helping me detect any unusual activity promptly.

VII. Use a Secure Network:

- When accessing my Cash App account, I always make sure I am connected to a secure and private Wi-Fi network to prevent unauthorized access.

VIII. Create a strong password:

- I use a unique and complex password for my Cash App account, incorporating a mix of letters, numbers, and special characters to enhance security.

IX. Contact Cash App Support:

- In case of any security concerns or suspected unauthorized access, I promptly reach out to Cash App support to report the issue and seek assistance.

By following these security measures, I can help safeguard my Cash App account and protect my funds from potential threats.

Educating others about potential pitfalls and effective solutions

As I navigated through handling canceled payments on the Cash App, I discovered some valuable insights that I believe are essential to share with others. Educating yourself about potential pitfalls and effective solutions can save you time and frustration in the long run. Here are some top tips to consider:

- Stay informed: Keep yourself updated on Cash App’s terms of service and payment policies to understand the rules regarding canceled payments.

- Double-check details: Before sending a payment, verify all recipient details to ensure accuracy and prevent any mistakes that could lead to canceled transactions.

- Contact support promptly: If you encounter a canceled payment, reach out to Cash App support immediately for assistance. They can provide guidance on the next steps to take.

- Be patient but persistent. Resolving canceled payments may take time, so stay patient throughout the process. However, don’t hesitate to follow up with support if necessary to ensure a prompt resolution.

By educating yourself about the potential pitfalls of canceled payments and implementing these effective solutions, you can navigate such situations with confidence and efficiency. Remember, staying proactive and informed is key to managing canceled payments on the Cash App effectively.

Conclusion and final thoughts

After going through these top tips for handling canceled payments on the Cash App, I feel more equipped to navigate any issues that may arise in the future. Here are my final thoughts on the matter:

- Stay vigilant: Always keep an eye on your Cash App account for any notifications or updates regarding your payments.

- Communication is key. Reach out to Cash App support at the first sign of a canceled payment to resolve the issue promptly.

- Document everything: Take screenshots of payment confirmations and any relevant conversations with support to have a record of the situation.

- Patience pays off: Dealing with canceled payments can be frustrating, but staying patient while the issue is resolved is crucial.

- Learn from the experience: Use any canceled payment as a learning opportunity to understand the platform better and avoid similar issues in the future.

In conclusion, handling canceled payments on the Cash App requires attention to detail, effective communication, and a level-headed approach. By following these tips, I am more confident in managing any challenges that may come my way when using the Cash App platform.

Leave a Reply