Analysing the US Inflation Rate by Year: 1929–2024

The annual U.S. inflation rate indicates the extent to which prices of goods and services increase from one year to the next. Beyond the limited perspective that average yearly inflation provides, an analysis of the inflation rate by year offers a deeper understanding of the variations in pricing for goods and services.

The inflation rate is known to respond to the different stages of the business cycle, which is the inherent pattern of growth and decline that the economy experiences over a period of time.

The Federal Reserve maintains a target annual inflation rate of 2% and employs monetary policy to control inflation and stabilise the economy in the event that inflation exceeds this benchmark.

Here’s an overview of the U.S. inflation rate by year:

- Introduction to US Inflation Rate

- Overview of the Inflation Rate from 1929–2024

- Factors Influencing US Inflation

- The Impact of Inflation on the Economy

- Comparison of Inflation Rates Over Different Periods

- Analysing the Causes of High Inflation Years

- Effects of Low Inflation Years

- The Role of Government Policies in Inflation Control

- Predicting Future Inflation Trends

- Conclusion and Recommendations

Introduction to US Inflation Rate

The US Inflation Rate is a key economic indicator that measures the percentage change in the general price level of goods and services over a specific period, typically reported on an annual basis. Understanding the inflation rate is crucial for policymakers, businesses, investors, and consumers, as it impacts various aspects of the economy.

Increased demand, production costs, governmental regulations, and global economic conditions are a few examples of the factors that can cause inflation. It is essential to analyse the inflation rate to assess the purchasing power of the currency, wage trends, and overall economic stability.

Tracking the US inflation rate by year allows for a comprehensive evaluation of how prices have evolved over time and how these changes have influenced the economy. By examining historical data and trends, analysts can identify patterns, forecast future inflation levels, and make informed decisions regarding monetary policy and investments.

This article delves into a detailed analysis of the US inflation rate from 1929 to 2024, exploring the various factors that have influenced inflation levels throughout different periods. By examining how inflation has fluctuated over the years, readers can gain insights into the economic landscape and better understand the implications of inflation for various stakeholders.

Overview of the Inflation Rate from 1929–2024

- Over the years, the inflation rate in the United States has experienced significant fluctuations as a result of various economic factors and historical events.

- The year 1929 marked the beginning of the Great Depression, a period of severe economic downturn that resulted in deflation rather than inflation.

- Following the end of World War II in 1945, the US experienced a post-war economic boom that led to an increase in inflation rates, peaking in the 1970s.

- The 1980s and 1990s saw a period of relatively stable inflation rates, thanks in part to the implementation of various monetary policies.

- As a result of the dot-com bubble burst and the fallout from the 9/11 attacks, inflation rates fluctuated in the early 2000s.

- In the aftermath of the 2008 financial crisis, the Federal Reserve implemented various monetary stimulus measures to combat deflationary pressures.

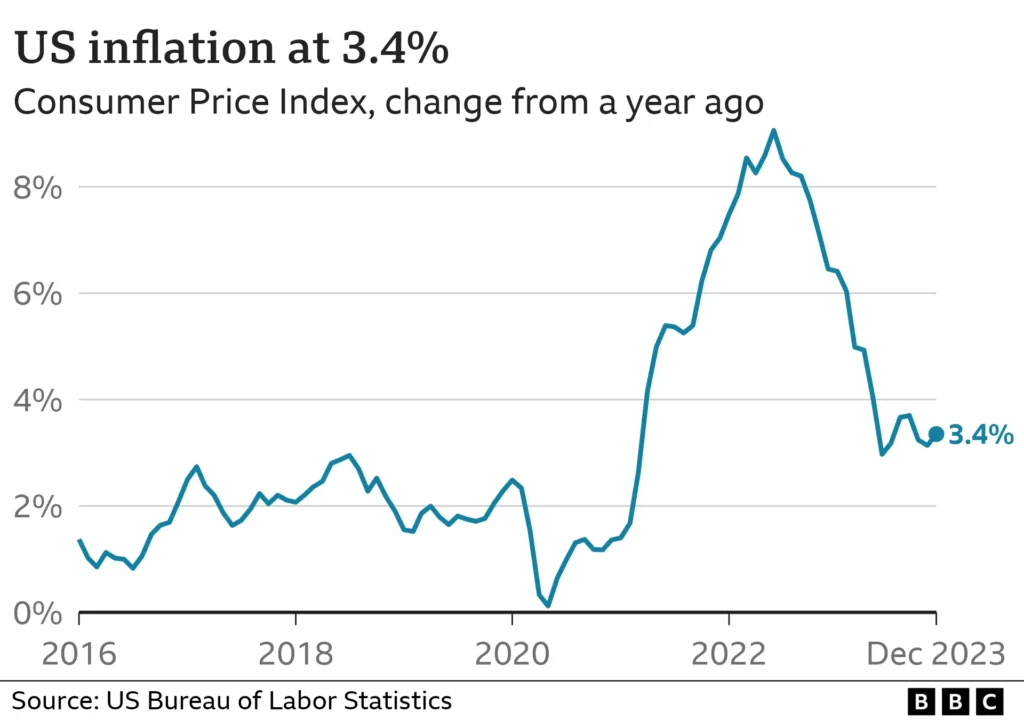

- The most recent years have seen a gradual increase in inflation rates, influenced by factors such as rising energy costs, increasing wages, and trade policies.

- Overall, analysing the inflation rate from 1929 to 2024 provides valuable insights into the economic history of the United States and the various factors that have influenced inflation over time.

Factors Influencing US Inflation

- There are a number of factors that affect inflation, including but not limited to:

- Monetary Policy: The actions taken by the Federal Reserve to control the money supply and interest rates can impact inflation rates. For example, when the Fed increases the money supply, it can lead to higher inflation as more money chases the same number of goods and services.

- Fiscal Policy: Government spending and taxation policies can also affect inflation. Increased government spending without corresponding revenue can lead to inflation, as more money is pumped into the economy without a proportional increase in goods and services.

- Demand-Pull Inflation: When the demand for goods and services exceeds supply, prices tend to rise. Factors such as consumer confidence, employment levels, and economic growth can all contribute to demand-pull inflation.

- Cost-Push Inflation: Rising production costs, such as labour or raw materials, can lead to cost-push inflation as businesses pass these increased costs onto consumers in the form of higher prices.

- Exchange Rates: Fluctuations in exchange rates can impact the prices of imported goods and services. A weaker domestic currency can lead to higher import prices, which can contribute to inflation.

- Supply Shocks: Events such as natural disasters, geopolitical tensions, or disruptions in the supply chain can cause sudden shifts in supply, leading to inflationary pressures.

- Inflation Expectations: The public’s expectations about future inflation can influence their behaviour and decisions, affecting actual inflation rates. If people anticipate higher prices in the future, they may demand higher wages or make purchases sooner, contributing to inflation.

Understanding these factors and how they interact is crucial in analysing and predicting changes in the US inflation rate over time.

The Impact of Inflation on the Economy

- Inflation is a key economic indicator that can have a profound impact on the economy. When prices rise across the board, the purchasing power of consumers decreases, leading to a decrease in overall economic activity.

- High inflation rates can erode savings as the value of money decreases over time. This can lead to a decrease in consumer confidence and spending, which in turn affects businesses and can result in lower levels of investment.

- Inflation affects not only individual consumers but also businesses. When the cost of raw materials and labour increases due to inflation, businesses may have to raise prices, leading to higher production costs and potentially lower profit margins.

- Inflation can also impact interest rates. Central banks may increase interest rates to combat high inflation, which can make borrowing more expensive for businesses and individuals. This can further dampen economic growth.

- On the other hand, low inflation rates are generally considered positive for the economy as they indicate price stability. This can lead to stable consumer spending, business investment, and overall economic growth.

- However, when inflation rates are too low, it can also signal weak demand in the economy, which can lead to deflationary pressures. Deflation can be detrimental to the economy, as falling prices can lead to lower production, lower wages, and increased unemployment.

In conclusion, the impact of inflation on the economy is multifaceted, affecting consumers, businesses, and overall economic growth. Monitoring inflation rates is crucial for policymakers to make informed decisions to ensure economic stability.

Comparison of Inflation Rates Over Different Periods

- The analysis of the US inflation rate from 1929 to 2024 reveals interesting trends and fluctuations over different periods.

- In the early 1930s, during the Great Depression, the inflation rate plummeted to record lows, indicating a deflationary period.

- Following World War II, the US experienced inflation spikes in the late 1940s and early 1950s due to post-war economic adjustments.

- The 1970s saw significant inflation rates attributed to various factors like the oil crisis and expansionary monetary policies.

- The Volcker era in the early 1980s stands out as inflation was aggressively tackled, leading to a period of high interest rates.

- The late 1990s and early 2000s witnessed relatively stable and low inflation rates amid economic growth and technological advancements.

- The 2008 financial crisis resulted in a brief deflationary period before inflation rates stabilised and remained modest in the following years.

- The COVID-19 pandemic in 2020 led to a mix of deflationary and inflationary pressures, impacting different sectors unequally.

- Comparing these inflation rates over different periods provides insights into the US economy’s resilience, response to crises, and overall stability.

Analysing the Causes of High Inflation Years

- Inflation rates are affected by a plethora of factors, such as demand-pull inflation, cost-push inflation, and expectations.

- Demand-pull inflation typically arises when consumer demand outstrips the economy’s ability to supply goods and services promptly.

- Cost-push inflation is usually triggered by a surge in production costs, leading to businesses passing on these extra expenses to consumers in the form of higher prices.

- Expectations play a pivotal role in the inflation rate since if individuals expect prices to rise consistently, they tend to purchase goods sooner, which can further fuel inflation.

- Economic growth, monetary policy, and global events can also significantly impact inflation rates in any given year.

- The Federal Reserve’s actions, interest rates, and government spending decisions can influence the inflation rate by either curbing or encouraging economic activity.

- Wars, natural disasters, political instability, and global economic shifts can introduce volatility and uncertainty, leading to fluctuating inflation rates.

- Technological advancements, labour market dynamics, and international trade relations might create inflationary pressure, impacting the overall inflation rate.

- Analysing the causes of high inflation years requires a comprehensive evaluation of various economic indicators, policies, and external influences to grasp the complexity of inflation trends accurately.

Effects of Low Inflation Years

- In low-inflation years, consumers benefit from stable prices, making budgeting and financial planning easier.

- Businesses may experience decreased profit margins due to their limited ability to increase prices, impacting investment and hiring decisions.

- Low inflation can lead to reduced wage growth as companies have less pressure to increase salaries.

- Central banks may implement expansionary monetary policies to combat deflation, including lowering interest rates to stimulate spending and borrowing.

- Investors may shift towards assets like stocks and real estate in low-inflation environments to seek higher returns.

- Low inflation can increase the real burden of debt for borrowers, as the value of debt does not erode as quickly over time.

- In a low-inflation environment, the purchasing power of consumers may increase as prices remain stable, leading to potential boosts in consumption and economic growth.

- However, persistently low inflation can also be a sign of economic weakness, potentially leading to deflationary pressures and decreased consumer spending.

These effects highlight the complex interplay between inflation rates and various economic factors, underscoring the importance of understanding and monitoring inflation trends for policymakers, businesses, and individuals alike.

The Role of Government Policies in Inflation Control

- Government policies play a crucial role in controlling inflation by influencing key economic factors.

- One of the primary tools used by the government to control inflation is monetary policy.

- The Federal Reserve can adjust interest rates to manage inflation levels by either raising rates to curb spending or lowering rates to stimulate economic activity.

- Fiscal policy is another important tool where the government can adjust spending levels and taxation to influence inflation.

- Government regulations also impact inflation by affecting the cost of production and the prices of goods and services.

- Supply-side policies, such as promoting competition and reducing barriers to entry, can help control inflation by increasing efficiency and lowering prices.

- Wage and price controls are occasionally used by governments to directly manage inflation by setting limits on wage increases and price hikes.

- However, such controls can have negative consequences and are often seen as temporary solutions.

- International trade policies can also impact inflation by affecting the prices of imported goods and raw materials.

- Overall, government policies play a significant role in managing inflation and maintaining economic stability through strategic interventions in various sectors of the economy.

Predicting Future Inflation Trends

- As the analysis of the US inflation rate by year from 1929 to 2024 reveals historical patterns and trends, economists and policymakers can use this data to make informed predictions about future inflation rates.

- By examining past data on factors such as economic growth, employment rates, monetary policy decisions, and consumer behaviour, experts can develop models to forecast potential inflation trends.

- Projections for future inflation rates can help businesses plan for potential price increases, consumers make informed financial decisions, and governments implement appropriate monetary policies to manage inflation levels effectively.

- Looking at historical highs and lows in inflation rates can provide valuable insights into potential future fluctuations, allowing for proactive measures to be taken to mitigate the impact of extreme inflation or deflation scenarios.

- Utilising advanced statistical analysis and econometric modelling techniques, economists can take into account various external factors, such as global economic conditions, political events, and technological advancements, to enhance the accuracy of inflation rate predictions.

- Predicting future inflation trends is crucial for maintaining price stability, ensuring sustainable economic growth, and safeguarding against potential financial risks in the market.

- By staying vigilant and continuously monitoring key economic indicators, policymakers can adapt their strategies to navigate changing inflation landscapes and proactively address any emerging challenges or opportunities on the horizon.

Conclusion and Recommendations

- The analysis of the US inflation rate from 1929 to 2024 reveals fluctuations influenced by various economic events and policies.

- The period between 1970 and 1980, marked by high inflation rates, showed the impact of oil price shocks and monetary policies.

- Following the Volcker disinflation in the early 1980s, the inflation rate stabilised significantly.

- The Great Recession of 2008 had a notable effect on inflation, leading to lower rates as a result of the economic downturn.

- Recommendations for policymakers include prudent monetary policy adjustments to maintain stable inflation rates conducive to economic growth.

- Continuous monitoring and analysis of inflation trends are essential for making informed decisions about fiscal and monetary policies.

- To mitigate the risk of high inflation, policymakers could consider mechanisms to address supply chain disruptions and cost-push inflation.

- Educating the public on the impact of inflation and measures to protect personal finances can help individuals navigate periods of rising prices.

- Businesses should incorporate inflation risk management strategies into their financial planning to counter the effects of inflation on operating costs.

- Researching historical trends in inflation rates can provide valuable insights for understanding the macroeconomic factors influencing price stability.

Leave a Reply