Personal finance planning in Nigeria is no longer optionality is a necessity, with rising inflation, unstable fuel prices, and unpredictable economic conditions, managing money without a plan can lead to constant stress and financial struggle.

Whether you earn a salary, run a business, or depend on daily income, having a financial plan helps you take control of your money instead of letting money control you.

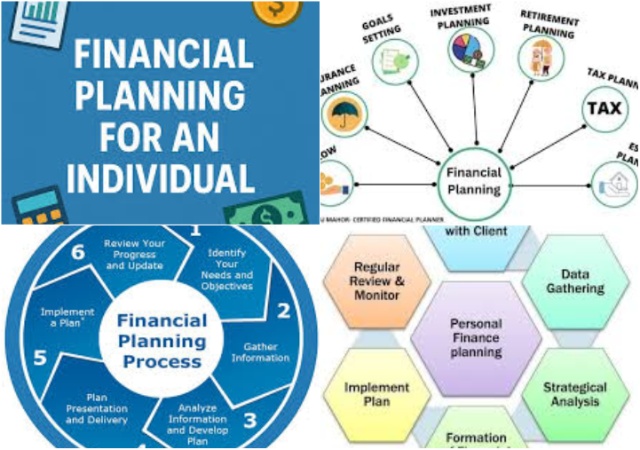

This guide explains personal finance planning in simple terms and shows you step-by-step how to budget, save, invest, and protect your finances for a stable future.

Introduction to Personal Finance Planning in Nigeria Why Financial Planning Is Important in Today’s Economy

Many Nigerians live from paycheck to paycheck, when unexpected expenses like, medical bills, school fees, or job loss comes, there is no backup plan.

Financial planning helps you prepare for such situations and gives you confidence about your future, Personal finance planning means:

- Knowing how much you earn

- Controlling how much you spend

- Saving regularly

- Investing wisely

- Protecting yourself from financial risks

Common Money Challenges Nigerians Faces

Some of the major financial problems include:

-Know Your Financial Situation

-Identify Your Income Sources

Your income is any money that comes into your hands regularly. Examples include:

- Monthly salary

- Business profits

- Freelance or online work

- Side hustles

- Allowances or support

Tracking Your Monthly Expenses includes:

- Rent or housing

- Food and groceries

- Transportation

- Electricity and water bills

- Internet and phone subscriptions

- School fees

- Entertainment

Difference Between Needs and Wants

- Needs: Food, rent, transport, school fees

- Wants: New phone, outings, fashion, luxury items

- Understanding this difference helps you cut unnecessary spending.

Set Clear Financial Goals

Short-Term Financial Goals (0–1 year)

- Save ₦100,000 for emergencies

- Clear a loan

- Buy a laptop

- Medium-Term Financial Goals (1–5 years)

- Buy land

- Start a business

- Pay for higher education

Long-Term Financial Goals (5+ years)

- Retirement

- Own a house

- Build investments

- Making Goals Specific and Measurable

- Instead of saying “I want to save,” say:

- “I want to save ₦300,000 in 12 months for emergencies.”

- This makes your plan clear and achievable.

Create a Realistic Budget

The 50/30/20 Budget Rule Explained

The 50/30/20 budget rule is a simple way to manage money by dividing income into three parts:

- 50% for Needs: essential expenses like rent, food, transport, utilities, and school fees.

- 30% for Wants: lifestyle spending such as entertainment, eating out, clothes, and subscriptions.

- 20% for Savings & Investments: emergency fund, savings, debt repayment, and investments.

The rule helps control spending, reduce debt, and build financial security. Nigerians can adjust the percentages based on income level or inflation, but the key principle is to always save something consistently. It encourages balance between living today and preparing for the future.

Budgeting Tips for Low and Irregular Income Earners

- Budget weekly instead of monthly

- Save a percentage, not a fixed amount

- Reduce lifestyle spending

Build Savings and Emergency Fund: Importance of Saving Regularly

Saving builds financial discipline and prepares you for future needs.

Automating Savings with Digital Tools

You can automate savings using platforms like PiggyVest, which allow you to save daily, weekly, or monthly without stress.

How Much to Save for Emergencies

An emergency fund should cover 3 to 6 months of basic expenses. This money should be for:

- Medical bills

- Job loss

- Family emergencies

- Start small and grow it gradually.

Manage Debt the Smart Way

Types of Debt in Nigeria

The main types of debt in Nigeria include:

- Bank loans: personal, business, and mortgage loans with lower interest and longer repayment periods.

- Loan apps (fintech loans): quick short-term loans with very high interest rates.

- Cooperative loans (ajo/esusu): low-interest loans from savings groups.

- Family and friends debt: informal borrowing without interest but can affect relationships.

- Buy Now Pay Later (BNPL): installment payments for goods like phones and electronics.

- Business debt: loans used to run or grow a business.

- Education loans: for school fees and training.

- Mortgage/housing debt: long-term loans for buying or building a house.

- Utility and bill debt: unpaid electricity, water, or internet bills.

- Informal local lenders: high-interest borrowing from market or street lenders.

Invest for Growth and Inflation Protection

Popular Investment Options in Nigeria

Here are the most common and trusted investment options Nigerians use to grow their money:

- Treasury Bills & Government Bonds: Low-risk investments backed by the government, good for beginners and safety.

- Mutual Funds: Professionally managed funds that invest in stocks, bonds, or money market instruments.

- Stocks (Equities): Buying shares of companies on the stock exchange for long-term growth and dividends.

- Fixed Deposit Accounts: Locking money in a bank for a fixed period to earn interest.

- Real Estate: Buying land or property for rental income or long-term value appreciation.

- Agricultural Investments: Farming and agribusiness opportunities (crop or livestock projects).

- Dollar/Foreign Currency Investments: Holding or investing in foreign currency to protect against naira inflation.

- Digital Investment Platforms: Fintech apps that allow easy access to savings and investment products.

- Small Business Investments: Starting or investing in a business for higher but riskier returns.

Beginner Investment Tips

- Start small

- Choose low-risk investments

- Learn before investing

- Be patient

Protect Your Money with Insurance

Types of Insurance to Consider

- Health insurance

- Life insurance

- Motor insurance

- Business insurance

- Why Insurance Is Part of Financial Planning

Insurance protects your savings from sudden disasters such as illness or accidents. Providers like Leadway Assurance help families remain financially secure during emergencies.

Review and Adjust Your Financial Plan

Monthly and Yearly Reviews

- Check your plan:

- Every month

- Every quarter

- Every year

- Tracking Financial Progress

- Ask yourself:

- Am I saving more?

- Is my debt reducing?

- Are my investments growing?

- Adjust your plan when income or expenses change.

Building a Strong Financial Future in Nigeria

Personalfinance planning in Nigeria is about discipline, consistency, and smart decisions.

You do not need to be rich to start, what matters is starting now by:

- Tracking income and expenses

- Setting clear goals

- Budgeting wisely

- Saving consistently

- Managing debt

- Investing for growth

- Protecting yourself with insurance

- you can build financial security and peace of mind over time.

- Small steps taken today will lead to big financial success tomorrow.

Leave a Reply