Best Loan Apps in Nigeria

I will begin by introducing the concept of loan apps in Nigeria. In recent years, the financial technology industry in Nigeria has witnessed significant growth, with various loan apps emerging to meet the borrowing needs of individuals and businesses. These loan apps offer a convenient and accessible way to access funds quickly, without the need for traditional bank visits or lengthy approval processes.

In Nigeria, loan apps provide users with a platform to apply for loans digitally using their smartphones. These apps typically require users to create an account, provide personal information, and undergo a fast evaluation process to determine their creditworthiness. Once approved, users can receive funds directly into their bank accounts within a short period of time, making it a popular choice for those in need of quick financial assistance.

It is essential to understand how loan apps operate, their terms and conditions, interest rates, repayment schedules, and other pertinent details before engaging with them. Each loan app may have its own unique features, eligibility criteria, and loan offerings, so users must carefully compare their options to select the best fit for their financial needs.

Users should exercise caution and conduct thorough research before choosing a loan app to ensure they are dealing with reputable and licenced financial institutions. Understanding the workings of loan apps in Nigeria is crucial to making informed borrowing decisions and avoiding falling into debt traps. In the following sections, I will delve into the top user-rated loan apps in Nigeria for 2024, providing insights into their features, pros, and cons based on user experiences.

Overview of the Loan App Market in Nigeria

I have closely examined the loan app market in Nigeria and found it to be a dynamic and competitive landscape. Here are some key points to understand about the market:

- Variety of Loan Apps: The loan app market in Nigeria is teeming with a variety of options to choose from. There are apps that cater to different financial needs, from personal loans to business funding.

- Interest Rates: Interest rates vary across loan apps in Nigeria. Some apps offer competitive rates, while others may have higher interest charges. It is essential for users to compare rates before selecting a loan app.

- Loan Limits: The loan limits provided by different apps differ significantly. Some apps offer small loans suitable for emergency needs, while others provide higher loan amounts for more substantial financial requirements.

- Repayment Terms: Repayment terms also vary among loan apps. Some apps offer flexible repayment schedules, while others have stricter terms. Users should consider the repayment options that align with their financial capabilities.

- Customer Service: The level of customer service provided by loan apps can influence the user experience. Apps with responsive customer support and clear communication are often preferred by borrowers.

- Security Measures: Data security is paramount when using loan apps. Users should opt for apps that have robust security measures in place to protect their personal and financial information.

- User Ratings and Reviews: User ratings and reviews can provide valuable insights into the credibility and reliability of loan apps in Nigeria. It is advisable to consider user feedback before choosing a loan app.

Criteria for Selecting the Top 5 Loan Apps

I consider the following criteria crucial when selecting the top 5 loan apps in Nigeria for 2024:

- Interest Rates: I look for loan apps with competitive interest rates to ensure that I am not overburdened with excessive repayment amounts.

- Loan Limits: I assess the maximum and minimum loan amounts offered by the apps to cater to both small and large financial needs.

- Repayment Flexibility: I prioritise loan apps that offer flexible repayment terms, such as longer tenures or the option to reschedule payments when needed.

- Customer Service: I value excellent customer service, including responsiveness to queries, helpfulness, and overall user experience.

- Application Process: I prefer apps with a user-friendly and streamlined application process that is hassle-free and quick.

- Approval Time: I prioritise apps with fast approval times to access funds promptly during urgent financial situations.

- Security Measures: I prioritise apps that prioritise data security and use encryption to keep personal and financial information safe.

- User Ratings and Reviews: I consider user ratings and reviews to gauge the experiences of other borrowers and ensure the reliability of the loan apps.

By focusing on these criteria, I can identify the top 5 loan apps in Nigeria that align with my financial needs and preferences.

Digital money lenders, sometimes known as loan apps, continue to play a big role in Nigeria’s informal economy by giving people easy access to loans quickly, despite problems with their business model, particularly with debt collection.

Because of this, the FCCPC, the agency in charge of consumer protection, has maintained time and time again that it cannot prohibit lending applications, despite widespread demands to the contrary.

The fact that many Nigerians would be left high and dry if lending apps were to be outlawed in the nation is more evidence of this.

Despite the numerous allegations of harassment and defamation related to loan apps, it is important to note that there are legitimate platforms operating within the law and following the guidelines set out by various organisations, such as the FCCPC and the industry Joint Task Force, which includes the Nigerian Communications Commission (NCC), the Central Bank of Nigeria (CBN), and the Economic and Financial Crimes Commission (EFCC), among others.

Although the FCCPC has authorised more than 200 lending applications at this time, user reviews provide a reliable metric by which to compare these services. The ratings and reviews that these applications get in the app stores usually reflect this.

Since the majority of lending applications are not accessible on the Apple Store, this list is based only on the Google Play Store. However, it should be noted that certain apps are also available on the Apple Store.

In January 2024, these were the top 10 lending applications in Nigeria, according to user reviews:

10. Xcrosscash (4.0)

Users are able to activate their credit limit using the Xcrosscash lending app. It provides quick loans with terms of 91–180 days and amounts between 10,000 and 50,000 Naira.

Despite having one of the lowest loan ranges, Xcrosscash has one of the greatest user reviews and over a million downloads on the Google Play Store. It is also one of the lowest among the top 10 apps. In January 2024, 32,846 users had given the app a rating of 4.0.

9. Renmoney (4.1)

Renmoney takes great delight in becoming the most convenient loan business in Nigeria, thanks to its innovative solutions that always provide exceptional customer service.

They provide loans between N50,000 and N6 million for individuals and small businesses. The software has received 4.1 stars from users and more than a million downloads on the Google Play Store. There were 22,687 ratings for the business as of January of this year.

8. Newcredit (4.1)

Newedge Finance Limited runs a number of lending applications, one of which is Newcredit. Instant, collateral-free loans from N10,000 to N300,000 are offered via the app, with payback options ranging from 91 to 365 days.

The folks at Newcredit claim to use AI to sift through potential borrowers’ credit reports, bank transaction SMS, and other financial data.

With more than 5 million downloads as of January this year, the app is among the most popular lending applications in Nigeria on the Google Play Store. There were 65,763 reviews for the NewCredit app.

7. Palm Credit (4.2)

Another Nigerian lending app operated by Newedge Finance Limited is Palmcredit. Instant loans without collateral are being made available to Nigerians via the app. Among Nigerian lending applications, this one ranks high with over 10 million downloads on Google Play, which is not unexpected. A respectable 173,017 users have given the app a 4.2 rating as of January of this year.

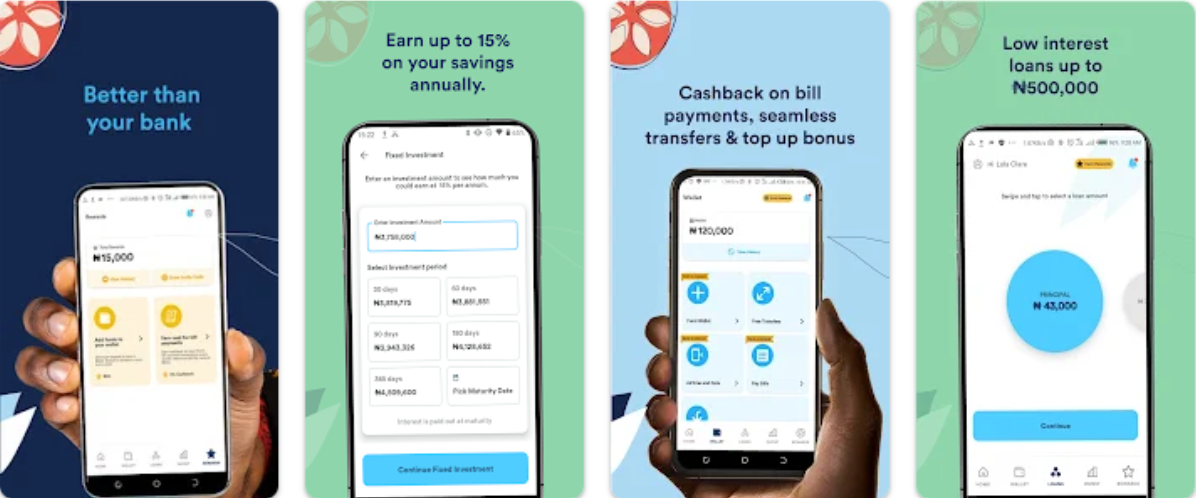

6. FairMoney (4.2)

Online lending is the main emphasis of FairMoney, a digital bank. In addition to a bank account and debit card, the firm offers quick loans of up to one million naira.

The firm boasts that one loan is given every eight seconds and that FairMoney executes more than 10,000 loans daily.

The fact that the fintech app has more than 10 million downloads shows this, since it is among the loan applications in the Play Store. The 587,808 people who evaluated the app by January 2024 gave it a 4.2 out of 5 rating, which they thought was fair.

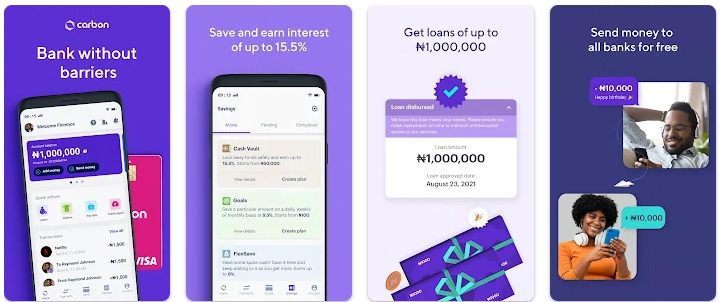

5. Carbon (4.3)

In addition to the standard digital banking services like debit cards, Carbon, a digital bank licenced by the Central Bank of Nigeria (CBN), offers a lending facility and investment options.

P2P payments, bill payments, and cellphone recharges are all possible with these accounts. More than one million users have downloaded the app from the Google Play Store. There have been 158,270 reviews of the app as of January of this year, with an average rating of 4.3 stars.

4. Wecredit (4.4)

Loan amounts ranging from N10,000 to N200,000 are available to Nigerians via WeCredit. According to the business, their APR ranges from 10% to 30%. There are a lot of Nigerians using this site to get fast loans; it has over a million downloads on the Google Play Store.

As of January 2024, 32,650 users have given Wecredit a rating of 4.4.

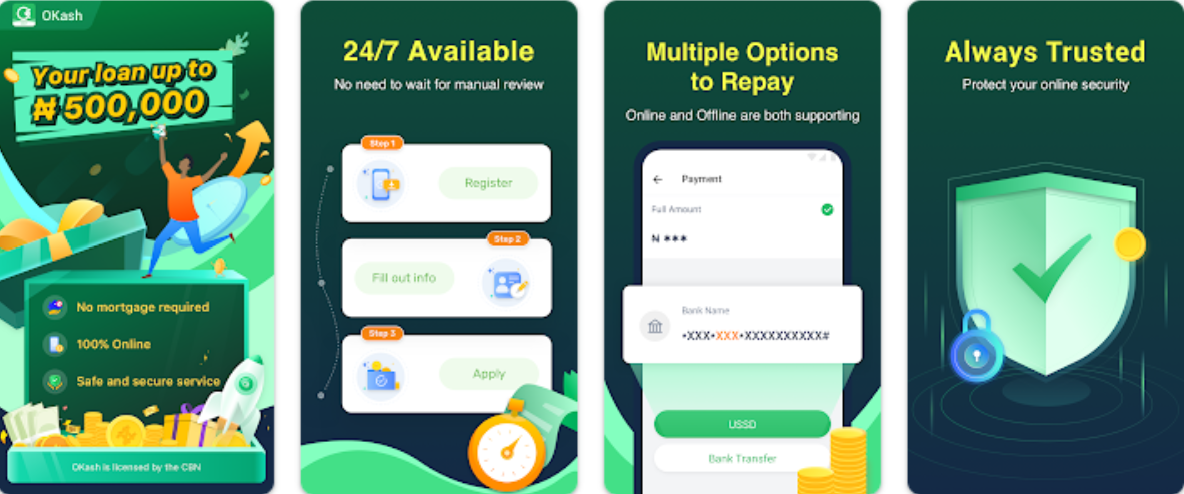

3. OKash (4.5)

Blue Ridge Microfinance Bank Limited runs OKash, an easy and fast online lending platform for mobile customers in Nigeria. OKash is available around the clock to meet all of its clients’ financial requirements online.

The applicant’s bank account receives the sanctioned loan amount after a brief application procedure requiring little paperwork.

You may get a loan with a payback term of 91 days to 365 days and a loan amount between N3,000 and N500,000 with this app. The OKash app has been downloaded over 5 million times, and it has 198,000 star ratings.

2. EasiMoni (4.5)

Blue Ridge Microfinance Bank also runs the EasiMoni app, which provides loans ranging from N3,000 to N1 million.

The interest rate on loans issued to consumers is determined by their credit assessment findings, and the firm indicates that it ranges from 5% to 10% every month. As of January of this year, the app had 222,145 users rating it 4.5 out of 5, and it had more than 5 million downloads on the Google Play Store.

1.Branch (4.5)

Branch is a top lending app in Nigeria and several other nations as well. The Branch app has a 4.5-star rating and the most reviews of any Nigerian loan app, thanks to its status as one of the most downloaded applications (nearly 10 million downloads on the Google Play Store). There were 1.3 million ratings for the app.

Using information stored on the user’s smartphone, the app establishes loan eligibility and provides tailored loan offers.

Prices for such loans vary between seventeen percent and forty percent. Loan amounts ranging from N2,000 to N1,000,000 are available to users in as little as 12 hours, with payback terms ranging from 4 to 40 weeks, depending on their repayment history.

Leave a Reply