AfriGo Card Scheme: Everything You Should Know

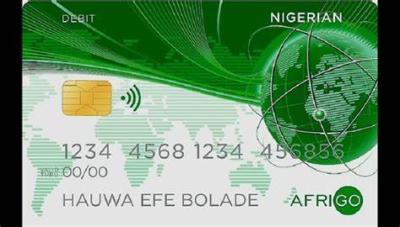

The Central Bank of Nigeria (CBN), in partnership with the Nigeria Inter-bank Settlement System (NIBSS), has introduced AfriGo, a new payment system, with the aim of enhancing the national payment infrastructure.

Godwin Emefiele, the CBN Governor, officially unveiled AfriGo, the first domestic card program in Africa, with the intention of encouraging the use of electronic platforms in Nigeria.

Emefiele declared that the new card program would offer additional choices for local consumers while also promoting the provision of services in a more inventive, economical, and competitive way.

Additionally, he clarified that AfriGo plays a crucial role in bridging the economic disparity resulting from the adoption of the cashless policy.

The ownership of AfriGo is held by the CBN and Nigerian banks. Nigeria has just initiated a domestic card plan, following in the footsteps of China, Russia, India, and Turkey.

Here’s an overview of the AfriGo Card Scheme:

- Introduction to AfriGo

- The Objectives of AfriGo

- The Key Features of AfriGo

- How to Get Started with AfriGo

- The Benefits of AfriGo for Consumers

- The Benefits of AfriGo for Merchants

- Security Measures in AfriGo

- Challenges and Opportunities for AfriGo

- The Future of AfriGo

- Conclusion

Introduction to AfriGo

I will provide you with an overview of the AfriGo card scheme, highlighting its features, benefits, and how it works. Let’s delve into the details of this innovative payment solution designed to enhance your financial transactions with convenience and security.

The Objectives of AfriGo

I aim to provide accessible financial services to all Africans, regardless of their location or banking history. My goal is to promote financial inclusion by offering a secure and convenient payment solution that can be used across the continent. Additionally, I strive to empower individuals to manage their finances effectively and participate in the digital economy. Through the AfriGo Card Scheme, I aspire to drive economic growth and improve the overall well-being of African communities.

The Key Features of AfriGo

- I set the spending limit on my AfriGo card to control my expenses easily.

- I can top up the card using various methods, making it convenient to manage my finances.

- With AfriGo, I have access to exclusive discounts and offers at partner merchants.

- The card offers increased security with EMV chip technology, protecting my transactions.

- AfriGo provides detailed transaction history, helping me track my spending accurately.

How to Get Started with AfriGo

I will guide you through the simple steps to get started with your AfriGo card:

- Visit the website: Go to the AfriGo website to learn more about the card and its benefits.

- Apply Online: Fill out the online application form on the website with your personal details.

- Verification Process: Wait for verification of your details by AfriGo.

- Receive Your Card: Once verified, you will receive your AfriGo card.

- Load Funds: Load the desired amount onto your card for your transactions.

- Start Using: You can now use your AfriGo card for purchases and transactions easily.

The Benefits of AfriGo for Consumers

- I can conveniently make purchases at a variety of retail outlets with the AfriGo card.

- I have the flexibility to manage my spending with the prepaid feature of AfriGo.

- I appreciate the added security that comes with using a chip-enabled card.

- I enjoy exclusive discounts and offers when using the AfriGo card at partner stores.

- I have peace of mind knowing that I can easily track my transactions online.

- I appreciate the convenience of easily reloading my card at authorized locations.

The Benefits of AfriGo for Merchants

I appreciate AfriGo’s dedicated merchant support team, which provides assistance whenever I encounter any issues or have questions about the card scheme. For merchants like me, the seamless integration of AfriGo into my existing payment system has significantly increased my customer base. The zero transaction fees on all AfriGo transactions have helped me save on costs and maximize profits. Additionally, the increased security features of AfriGo provide peace of mind, ensuring that all transactions are safe and secure. Overall, AfriGo has been a game-changer for my business, offering convenience, cost savings, and security all in one package.

Security Measures in AfriGo

- Security is a top priority for AfriGo, and I take every precaution to protect your sensitive information.

- I ensure that all data is encrypted using the latest security protocols to prevent unauthorized access.

- Regular security audits are conducted to identify and address any vulnerabilities in the system.

- Multi-factor authentication is implemented to ensure that only authorized users can access the AfriGo platform.

- In the event of any suspicious activity, I have a dedicated team to monitor and respond promptly to mitigate any security threats.

Challenges and Opportunities for AfriGo

- Challenges:

- Market Competition: Keeping up with other established card schemes can be challenging.

- Customer Adoption: Educating the market on the benefits of AfriGo may take time.

- Regulatory Hurdles: Adhering to changing financial regulations can pose challenges.

- Opportunities:

- Market Growth: The increasing demand for digital payment solutions presents a vast opportunity.

- Financial Inclusion: AfriGo can help bring financial services to the unbanked population.

- Partnerships: Collaborating with local businesses can expand the reach and usability of AfriGo.

The Future of AfriGo

- I see a bright future for the AfriGo card scheme, with its innovative features and user-friendly interface.

- The potential for expansion into more African countries is immense, offering convenience and financial inclusion to a broader population.

- By continually enhancing security measures and staying ahead of evolving technology trends, AfriGo is poised to become a leading financial solution in the region.

- I believe that partnerships with local businesses and government entities will further solidify AfriGo’s position as a trusted payment method in Africa.

Conclusion

I have outlined the various benefits and features of the AfriGo Card Scheme, including its convenience, security, and financial management tools. By understanding how the scheme works and its advantages, individuals can make informed decisions about using this payment solution. As we navigate the evolving landscape of digital transactions, the AfriGo Card Scheme emerges as a reliable option for those seeking efficient and secure payment methods. With this scheme, users can experience streamlined transactions and enhanced financial control, making it a valuable tool in today’s digital ecosystem.

Leave a Reply